The Prepaid Insurance Account Had a 6000 Debit Balance

Pages 7 This preview shows page 4 - 6 out of 7 pages. School Public School.

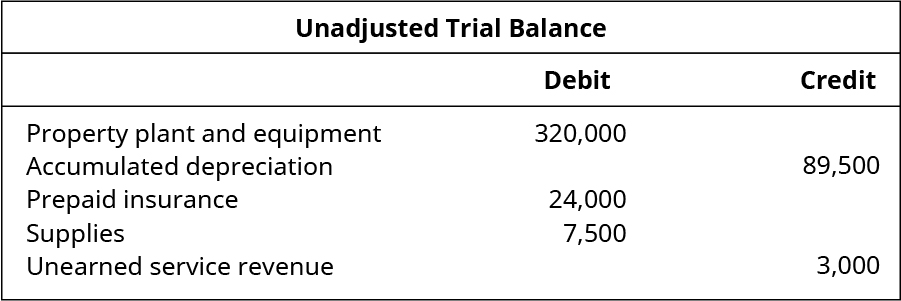

Solved Lynn Trading Company Unadjusted Trial Balance Chegg Com

The Prepaid Insurance account had a 6000 debit balance at December 31 before adjusting for the costs of any expired coverage.

. The Prepaid Insurance account had a 6800 debit balance at December 31 2013 before adjusting for the costs of any expired coverage. The prepaid insurance account had a 6000 debit balance at december 31 before adjusting for the costs of any expired coverage. An analysis of insurance policies showed that 5800 of coverage had expired.

B The Prepaid Insurance account had a 6000 debit balance at December 31 before. An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains. An analysis of insurance policies showed that 5800 of coverage had expired.

The Prepaid Insurance account had a 6000 debit balance at December 31 2017 before adjusting. An analysis of rental policies showed that 5800 of rental coverage had expired. As a result of these two oversights the financial statements for the reporting period will.

The Prepaid Insurance account had a 6000 debit balance at December 31 before adjusting for the costs of any expired coverage. The Prepaid Insurance account had a 6000 debit balance at December 31 2013 before adjusting for the costs of any expired coverage. B The Prepaid Insurance account had a 6000 debit balance at December 31 2013 from ACCT 1010 at Nashville State Community College.

The Office Supplies account had a 250 debit. The Prepaid Insurance account had a 6800 debit balance at December 31 2013 before adjusting for the costs of any expired coverage. The prepaid insurance account had a 6800 debit.

Depreciation on the companys equipment for 2017 is computed to be 18000the prepaid insurance account had a 6000 debit balance at december 31 2017 before adjusting for the costs of any expired coverage. Wage expenses of 3200 have been incurred but are not paid as. Course Title ACCT 6521.

An analysis of the companys insurance policies showed that 1220 of unexpired insurance coverage remains. B the prepaid insurance account had a 6000 debit. The Prepaid Rent account had a 6800 debit balance at December 31 before adjusting for the costs of any expired coverage.

An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains. The Prepaid Insurance account had a 6000 debit balance at December 31 before adjusting for the costs of any expired coverage. The Supplies account had a 700 debit.

The Prepaid Insurance account had a 6000 debit balance at December 31 2015 before adjusting for the costs of any expired coverage. During 2013 5223 of. An analysis of the companys insurance policies showed that 1900 of unexpired insurance coverage remains.

Prepaid expense account had a 6000 debit balence at December 31 2013 before adjusting for the costs of any expired coverage. Wage expenses of 3200 have been incurred but are not paid as of December 31 2013. The Prepaid Insurance account had a 6800 debit balance at.

An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remainsthe office supplies account had a 700 debit. School East Carolina University. The Prepaid Insurance account had a 6000 debit balance at December 31 before adjusting for the costs of any expired coverage.

An analysis of the companys insurance policies showed that 840 of unexpired insurance coverage remains. An analysis of insurance policies showed that 5800 of coverage had expired. Wage expenses of 3200 have been incurred but are not paid as of December 31 2013.

An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains. The Prepaid Insurance account had a 7000 debit balance at December 31 2017 before adjusting for the costs of any expired coverage. Wage expenses of 3200 have been incurred but are not paid as of December 31 2013.

An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains. An analysis of the companys insurance policies showed that 1680 of unexpired insurance coverage remains. An analysis of the companys insurance policies showed that 1100 of unexpired insurance coverage remains.

This 3200 cost had been initially debited to the Prepaid Insurance account. Course Title AC MISC. Pages 3 This preview shows page 2 -.

The company also failed to record accrued salaries expense of 52000. The Office Supplies account had a 410 debit balance on December 31 201 2. The Prepaid Insurance account had a 7000 debit balance at December 31 before adjusting for the costs of any expired coverage.

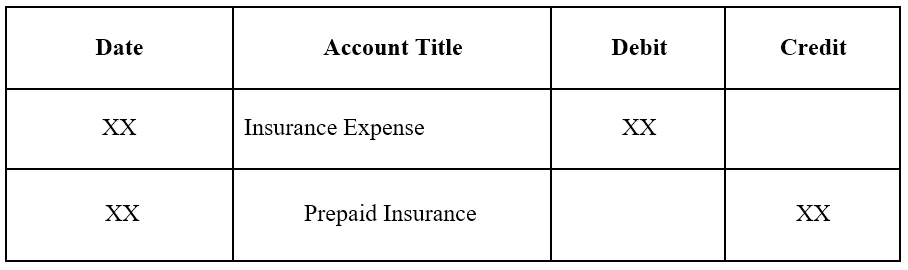

The Prepaid Insurance account had a 6000 debit balance at December 31 2017 before adjusting for the costs of any expired coverage. An analysis of the companys insurance policies showed that 1840 of unexpired insurance coverage remains. Journalize the adjusting entry required at the end of the year assuming the amount of unexpired insurance related to future periods is 4200.

The Prepaid Insurance account had a 6000 debit balance at December 31 2013 before adjusting for the costs of any expired coverage. The prepaid insurance account had a beginning balance of 6000 and was The prepaid insurance account had a beginning balance of 6000 and was debited for 7200 of premiums paid during the year. The Prepaid Insurance account had a 6800 debit balance at December 31 2013 before adjusting for the costs of any expired coverage.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

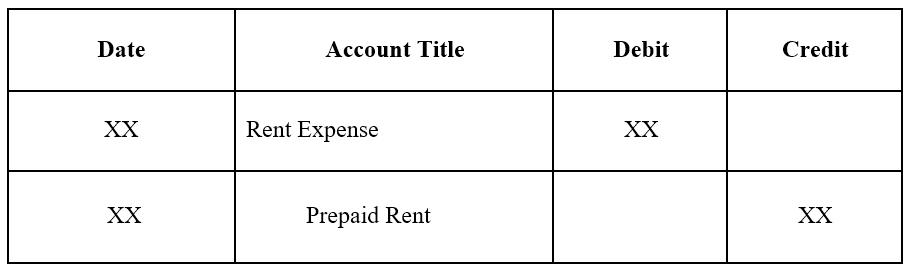

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

No comments for "The Prepaid Insurance Account Had a 6000 Debit Balance"

Post a Comment